Is Productivity Accelerating? Some Initial Thoughts

By Gad Levanon

Introduction

The decade preceding the pandemic was marked by the lowest productivity growth ever recorded in the U.S., raising serious concerns about the nation's long-term economic prospects. However, the recent surge in productivity over the past 5 years, particularly in the last 4-5 quarters, potentially signifies a reversal and suggests a positive shift that appears to be unique to the U.S. among major advanced economies. Is the acceleration in labor productivity growth sustainable? Very few economic related questions are more important. While it is too early to reach definite conclusions, below are some early thoughts.

This resurgence is primarily driven by a significant increase in capital investments, especially in software and research and development. Additional key factors contributing to this acceleration include the transformative impact of digitalization and creative destruction, which has reallocated resources to more efficient businesses. Furthermore, the expansion of West Coast technology companies into various sectors has disrupted traditional business practices and driven productivity improvements across the board. Labor shortages have also played a role, as companies have increasingly turned to automation and optimized workforce strategies to maintain output. The introduction and integration of Generative AI into various industries may have further boosted productivity.

These dynamics, largely catalyzed by the pandemic, are expected to support strong productivity growth in the near term. While this growth may not reach the heights seen in the late 1990s and early 2000s, it is poised to significantly outpace the sluggish growth observed in the 2010s. Beyond the near term, the rate of productivity growth will largely depend on the transformative potential of generative AI. Although there is limited data to rely on, I am cautiously optimistic about its potential to sustain longer-term gains.

This resurgence in productivity has the potential to substantially improve living standards and reduce inflation. However, it could also widen economic disparities across the country.

Recent Productivity Trends

In the past 4-5 quarters, labor productivity has been rapidly improving. From a business cycle perspective, this is happening at a time when one wouldn’t expect unusually strong growth in labor productivity.

Historically, labor productivity growth is strong in the 1-2 years following a recession. However, in the past 4-5 quarters, we've observed strong productivity growth occurring 3-4 years after the pandemic recession. This atypical timing suggests that there may be factors at play beyond the usual cyclical fluctuations in productivity. The data in the chart are likely to be revised up for 2023-2024 due to the expected revisions to the jobs data.

As shown in the chart above, productivity tends to be highly volatile when viewed on a 4-quarter basis. To gain a clearer understanding of productivity trends, it's more effective to analyze data over longer periods.

Notably, the five-year percent change in productivity is now much higher than in the previous five years. While this is a positive sign, it's important to consider that the comparison spans a period disrupted by the pandemic, making it less straightforward to draw direct parallels.

It is interesting though that when using OECD data, we see that the boost in productivity growth in 2018-2023 versus 2013-2018 was unique to the US. In most other advanced economies, the productivity growth in 2018-2023 was abysmal. The U.S. comparative advantage in technology, has likely played an important role in the unique boost in productivity seen from 2018 to 2023.

Source: OECD

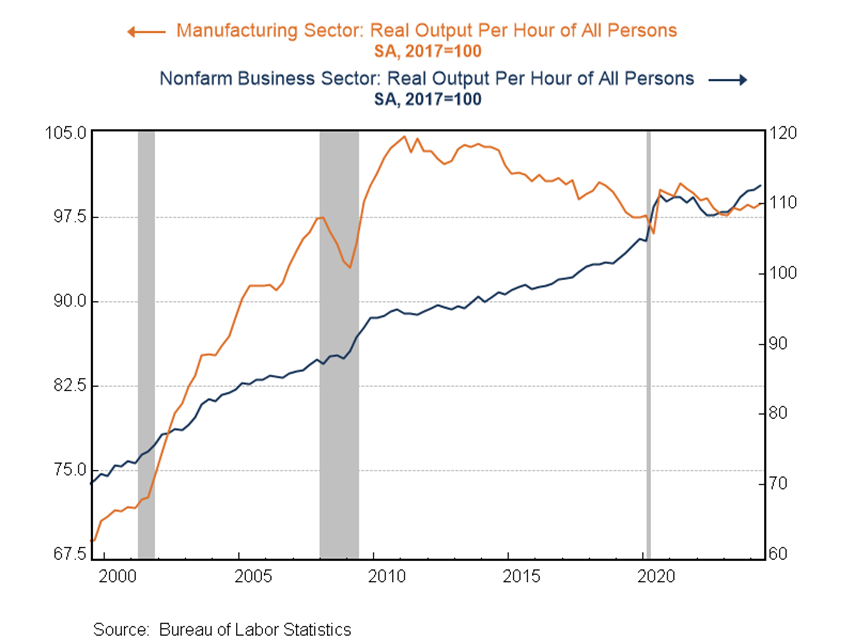

Productivity growth in the U.S. shows significant variation across sectors. As illustrated in the chart below, the manufacturing sector has experienced a plateau in productivity over the past decade, with a slight decline in some instances. It appears that the most straightforward gains from substituting technology for labor in manufacturing were largely realized by 2010.

To better understand the recent growth in labor productivity we need a few definitions:

1. Labor Productivity: Labor productivity measures the amount of goods and services produced per hour of labor. Labor productivity growth is a sum of three factors below:

2. Contribution of Capital Intensity: Capital intensity refers to the amount of capital (e.g., machinery, equipment, software, knowledge from R&D) used per unit of labor. The contribution of capital intensity to labor productivity measures how much of the productivity growth is due to increases in the amount or quality of capital per worker.

3. Contribution of Labor Composition: Labor composition refers to the quality or skill level of the workforce, which can include factors such as education.

4. Total Factor Productivity (TFP): Total Factor Productivity (TFP) represents the portion of output not explained by the amount of inputs used in production (i.e., labor and capital). It captures the efficiency with which labor and capital are used together in the production process. TFP is often seen as a measure of innovation, technological improvements, organizational changes, and other factors that lead to more efficient production processes.

Breaking down the acceleration in labor productivity growth between 2013-2018 and 2018-2023 (look at the green bar), we find that it came mostly from the larger contribution from capital intensity.

Source: Bureau of Labor Statistics

The growing contribution of capital intensity to GDP is increasingly driven not by traditional investments in equipment and structures but by significant investments in software and research and development (R&D). Since the late 2010s, and particularly following the onset of the pandemic, the impact of these investments has surged. This shift was fueled by the widespread move to remote work, education, and services, necessitating extensive digital transformation across organizations. Additionally, the rapid advancement and implementation of artificial intelligence (AI) have further accelerated this trend.

However, despite these substantial investments, total factor productivity (TFP), the efficiency with which labor and capital are used, has not yet shown a corresponding acceleration, remaining modest by historical standards. There is hope that like the productivity surge observed during the 1995-2005 period following large-scale capital investments, these recent investments will eventually lead to stronger gains in TFP.

What other factors may have contributed to the acceleration in productivity growth?

More creative destruction: The simultaneous surge in Private Sector Gross Job Gains at Opening Establishments and Gross Job Losses at Closing Establishments since the onset of the pandemic likely played a significant role in boosting U.S. labor productivity. This period saw a marked increase in creative destruction, as resources were reallocated from less efficient businesses to more productive ones, fueled by heightened entrepreneurial activity. However, it's worth noting that Job Gains at Opening Establishments have trended downward slightly over the past year, which may suggest a lower contribution to productivity growth moving forward.

Expansion of west coast tech companies: West Coast tech companies are more efficient and productive than many U.S. firms. In recent years, they've expanded into sectors like finance, healthcare, retail, automotive, education, entertainment, agriculture, and logistics. This expansion has disrupted traditional practices, raising productivity across these industries. Their soaring market capitalization reflects strong investor confidence in their continued influence and growth. As these companies keep innovating and investing in emerging technologies they are poised to drive further productivity gains.

Labor Shortages: During the labor shortages of 2018-2019 and 2021-2023, companies accelerated productivity growth by investing in automation and advanced technologies, reducing their reliance on scarce labor. These shortages also led firms to optimize workforce utilization and innovate business processes, shifting towards more capital-intensive operations. This transition resulted in higher output with fewer workers, driving significant productivity gains.

Generative AI: Since late 2022, the evolution of generative AI appears to have had some positive impact on labor productivity in various sectors. By automating tasks such as content generation, coding, data analysis, and customer support, AI has likely enabled workers to shift focus to higher-value activities. In industries like marketing, software development, and finance, AI tools seem to have accelerated certain workflows, potentially leading to quicker decision-making and improved output. These are still early days though, and we can’t quantify the magnitude of the impact of generative AI

In sum, here are the key factors that may have impacted faster productivity growth in recent years:

· Increased Capital Intensity - Increased investment in software and R&D.

· Digital Transformation – including shift to remote work and services.

· Creative Destruction - Reallocation of resources to more efficient businesses.

· West Coast Tech Expansion - Disruption and efficiency across various sectors.

· Labor Shortages - Automation and workforce optimization

· Generative AI - Automation of tasks and improved decision-making.

Most of these factors were triggered by the pandemic economy and are likely to have a stronger impact in the near term than in the longer term. Therefore, I anticipate relatively strong productivity growth over the next 2-3 years. Beyond the near term, generative AI is expected to become the primary driver of productivity. While there is limited precedent to rely on, I am cautiously optimistic about its potential to sustain longer-term gains. While I don't expect productivity growth to return to the golden days of 1995-2005, I do believe it will significantly outpace the slower growth seen in the 2010s.

Implications:

If labor productivity were to grow rapidly in the coming years, it could have several significant implications for the U.S. economy and labor market:

Increased productivity could reduce the need for additional workers if productivity outpaces demand growth, potentially loosening the labor market. In the current demographic environment, rapid productivity growth can counterbalance the effects of a slow-growing or even shrinking labor force.

Productivity growth can lower unit labor costs, as businesses produce more with the same or fewer labor inputs, helping increase profitability. Stronger productivity growth could also lower inflation control inflation by reducing the need for businesses to raise prices to cover labor costs.

Periods of strong productivity growth could lead to growing income and wealth inequality, as business owners and senior executives benefit more than workers. In addition, economic benefits could be uneven across regions, with areas with higher tech concentration experiencing more growth.

But most of all, labor productivity is the main determinant of living standards. By increasing the efficiency with which goods and services are produced, it allows economies to generate more wealth from the same amount of resources, directly boosting the quality of life.